Both refundable and non-refundable incentives are available to investors coming to or expanding in Hungary. The main types of incentives related to investments are cash subsidies (either from the Hungarian Government or from EU Funds), tax incentives, low-interest loans, or land available for free or at reduced prices. The regulations on incentive opportunities are in accordance with EU rules.

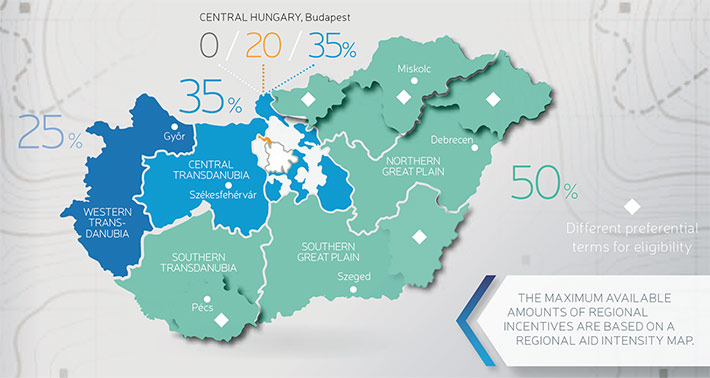

REGIONAL AID INTENSITY:

The maximum available amounts of regional incentives are based on a regional aid map. Most regions of Hungary are qualified for incentives, and aid intensity varies for large corporations, while small- and medium-sized companies are able to increase the intensity of the received subsidies. When calculating the maximum available amount of regional incentives, all regional incentives – including cash subsidies, development tax incentive, etc. – need to be taken into account.

List of available incentives:

- Tax allowance

- Development tax incentives

- Subsidy based on individual government decision

- Subsidies based on asset investment

- Subsidies for Business Service Centers (BSCs)

- Subsidies for R&D projects

- Workshop establishment and development subsidy

- Training subsidy

- Subsidies from EU funds

Download:

- To get a complete picture, please consult the official brochure of HIPA.

Further assistance:

- For a more detailed overview of the available incentives in Hungary, please visit the website of Hungarian Investment Promotion Agency.